To Investors Considering Purchasing DISCO Shares

DISCO’s role is to evolve advanced Kiru, Kezuru, and Migaku technologies and continue providing products to society in an accessible form, as defined in our Mission.

Growth in scale, including sales figures and global shares, is something that DISCO can obtain as a result of our activities, but it is not our goal. DISCO believes that striving to increase Mission-achievability connects to increase in our Value-exchangeability and competitiveness, and enables us to respond to the expectations of all capital-market stakeholders.

Therefore, capital utilization and return will be conducted based on the following principles.

Pursuing Quality of Business

DISCO will always focus on advanced Kiru, Kezuru, and Migaku technologies and continue to improve the quality of our business. The following items have been set as specific indexes.

Four-year consolidated ordinary income margin of 20% or more

Four-year consolidated RORA (return on risk assets) of 20% or more

Reference: RORA calculation formula

Principles

- By improving the quality of business, DISCO aims to cover capital costs and improve corporate value.

- Because the industry to which DISCO belongs is volatile, DISCO will evaluate business through a medium-to-long-term perspective, such as four-year consolidated figure evaluations, instead of short-term quarterly or annual evaluations.

- With efficiency of the assets essential to business as the goal, DISCO will improve not only capital efficiency but also the efficiency of low liquidity capital, such as inventories and fixed assets.

Utilization of Tangible Net Worth and Purpose

DISCO believes that utilization of tangible net worth is important for flexible business management and R&D activities.

- DISCO believes that improvement of return on equity (ROE) is important, but, instead of making ROE itself the goal, aims to build the capital composition required for flexible business operation.

- DISCO utilizes tangible net worth and procures capital to make the company stronger while considering the possible impact not only on quantitative capital cost but also on capital usage and business/organizational management.

Capital will be utilized to strengthen the company based on the principles above.

- DISCO will conduct capital investment to strengthen the company in preparation for sudden fluctuations in demand.

- DISCO will strive to strengthen the company by pursuing advanced Kiru, Kezuru, and Migaku technologies through constant R&D to provide new value as desired by the customer.

Shareholder Return Policy

Regarding return for our shareholders, who have generously continued to support DISCO over the long term, the basic policy will be return in the form of dividends.

Regarding Dividends

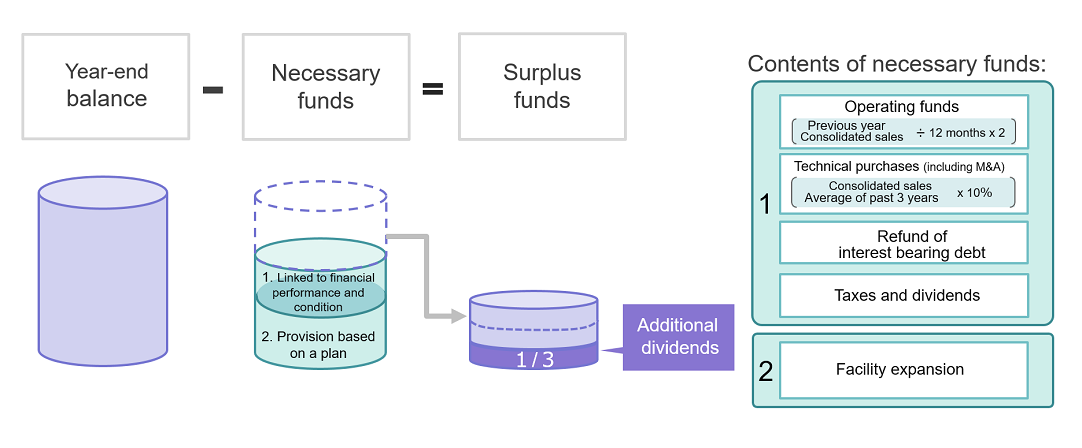

The basic dividend payout ratio is 25% (performance-based). At the end of the fiscal year, if surplus funds are generated after calculation of the investment capital for future operations, an additional dividend* of one-third of the surplus funds will be paid out as return.

When surplus funds are generated, if all the dividends are paid out at one time, the dividends for that fiscal year will be high, but a significant dividend cut will occur in the next year. In order to prevent this from occurring, the surplus funds will be equalized and paid out in one-thirds each year to provide stable payment.

■ Performance-Based Dividend

*Additional dividend calculation formula

■ Dividend Amount and Dividend Payout Ratio Change

Unit: JPY

| Dividends | Source of dividends | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 | FY24 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1H Dividend | Dividend payout ratio 25% (performance-based) |

28 | 28 | 47 | 38 | 30 | 39 | 66 | 94 | 76 | 124 |

| 2H Dividend | 26 | 29 | 40 | 29 | 34 | 52 | 87 | 98 | 119 | 163 | |

| Additional dividends | Surplus funds | 51 | 68 | 43 | 40 | 82 | 135 | 116 | 114 | 112 | 126 |

| Dividends (Annual Rate Per Share) |

- | 105 | 125 | 130 | 107 | 146 | 226 | 269 | 305 | 307 | 413 |

| Dividend Payout Ratio | - | 48.8% | 55.3% | 37.6% | 40.1% | 56.9% | 62.4% | 44.0% | 39.9% | 39.5% | 36.1% |

Share buyback

While taking into account capital efficiency and management environment, DISCO is considering share buyback as one method of return in addition to dividends.

Share buyback would be conducted by disposing of treasury shares so that the share price is kept at a level at which net assets per share do not substantially decrease. Acquired treasury shares will in principal be disposed.

Share buyback will be conducted for the purpose of returning profit to all shareholders, including existing and new, from a long-term perspective by increasing the value of each share.

■ Net Assets per Share and DISCO Share Price Change

| Unit:JPY | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | FY23 | FY24 |

|---|---|---|---|---|---|---|---|---|---|---|

| Net Asset Per Share | 1,558 | 1,676 | 1,895 | 2,031 | 2,091 | 2,322 | 2,703 | 3,202 | 3,740 | 4,530 |

| Share price at the end of Marck | 3,180 | 5,643 | 7,650 | 5,257 | 7,120 | 11,583 | 11,467 | 15,300 | 57,190 | 29,895 |

※The Company implemented a stock split in the proportion of 1 share into 3 shares effective as of April 1, 2023.

Dividend Amount and Net Assets per Share are caluculated taking into account the stock split implemented on April 1, 2023.

Total of itemized figures may not add up to totals because itemized figures are rounded.

Based on the above principles, DISCO welcomes all investors in the capital market dedicated to supporting DISCO from a long-term perspective.

Action to Implement Management that is Conscious of Cost of Capital and Stock Price

Analysis of Present State

DISCO understands that corporate value improves with compounding profit in excess of capital costs. For this reason, DISCO believes that structural strength is essential to business. Therefore, DISCO continues to work toward further strengthening its business structure.

In addition, DISCO recognizes that improving organizational structure to support strong business structure is an important issue.

DISCO realizes that high market share and profitability leading to heightened business quality are the results of “initiatives taken to strengthen the company,” starting with the nurturing of a high-quality corporate culture (permeation of DISCO VALUES) and including the individual managerial accounting system (Will Accounting), the system for continued evolution (PIM activities), research and development of advanced Kiru, Kezuru, and Migaku technologies, and excellence in in-house manufacturing and self-production.

DISCO believes that strong organizational management is not something that can be successfully imitated overnight and is what differentiates DISCO from both continuity and structural standpoints.

Thus, in order to improve not only capital efficiency but also asset efficiency, an essential in business, it is important to improve the efficiency of low liquidity assets, such as inventory and fixed assets. DISCO has used RORA (return on risk assets) as a management index since 2003, with the goal defined as maintaining a four-year consolidated RORA of 20% or more.

DISCO recognizes that improving this four-year consolidated RORA results in capital productivity exceeding capital costs.

In addition, although a four-year consolidated RORA of 20% or more has been defined as the minimum standard, DISCO has implemented measures to promote a constant company-wide awareness of capital costs as well, including linking the achievement of this goal to employee bonuses. While DISCO works to prevent increases in assets, which act as the denominator in various indexes, by maintaining this constant awareness of RORA, DISCO also aims as a company to increase profit, which acts as the numerator, by closely linking profitability and the amount of profit to officer and employee bonuses.

Although the important index of ROE itself is not tracked, DISCO has carried out operations with an awareness of both this denominator and this numerator for over 20 years, as explained above, and our analysis has shown that ROE far exceeds the market average as a result. DISCO will continue to place importance on the important issue of increasing this numerator while keeping this denominator low.

Four-Year Consolidated RORA and ROE

Proactive Dialogue with Investors

DISCO proactively engages in dialogue with the capital market to convey the initiatives taken to strengthen the company as well as to gain ideas related to better management.

In addition to quarterly financial results briefings, DISCO holds various forms of dialogue with domestic and international investors, including individual meetings with institutional investors and analysts, group meetings and technical briefings organized by DISCO, group meetings and conferences for institutional investors organized by brokerage firms, etc.

Number of institutional investors/analysts engaged in dialogue*

Period ending March 2025: 4,450

Period ending March 2024: 3,540

Period ending March 2023: 1,190

Period ending March 2022: 1,480

Period ending March 2021: 1,130

*Figures were calculated based on the total number of people engaged in dialogue (excluding participants at financial results briefings).

Meetings were individual or group meetings held online or in person.

Participants were domestic/international buy-side analysts, portfolio managers, sell-side analysts, etc.

DISCO will continue to use these dialogues with the capital market to convey the initiatives taken to strengthen the company, and will strive to keep improving the company's corporate value.